Guided Wealth Management Fundamentals Explained

Guided Wealth Management Fundamentals Explained

Blog Article

Guided Wealth Management Can Be Fun For Everyone

Table of ContentsThe 10-Second Trick For Guided Wealth ManagementThe 6-Minute Rule for Guided Wealth Management4 Simple Techniques For Guided Wealth ManagementSome Of Guided Wealth ManagementTop Guidelines Of Guided Wealth Management

For even more tips, see keep an eye on your financial investments. For investments, pay payable to the item copyright (not your advisor) (financial advisers brisbane). Routinely examine purchases if you have an investment account or utilize an investment system. Providing a monetary consultant total accessibility to your account enhances threat. If you see anything that does not look right, there are steps you can take.If you're paying a continuous recommendations fee, your advisor ought to evaluate your financial circumstance and meet you at least yearly. At this conference, make certain you discuss: any kind of modifications to your goals, scenario or financial resources (including modifications to your income, expenses or possessions) whether the level of risk you're comfortable with has actually transformed whether your current individual insurance coverage cover is ideal how you're tracking versus your objectives whether any changes to legislations or economic products might influence you whether you have actually gotten every little thing they guaranteed in your agreement with them whether you need any adjustments to your strategy Each year a consultant have to seek your composed grant charge you continuous guidance charges.

This might take place during the conference or digitally. When you enter or restore the recurring fee setup with your advisor, they need to explain exactly how to end your partnership with them. If you're transferring to a new advisor, you'll need to arrange to transfer your economic documents to them. If you need aid, ask your adviser to explain the process.

What Does Guided Wealth Management Mean?

As an entrepreneur or small business proprietor, you have a lot going on. There are several obligations and expenditures in running a service and you definitely do not require another unneeded expense to pay. You require to meticulously think about the return on investment of any type of solutions you reach ensure they are beneficial to you and your service.

If you're one of them, you might be taking a substantial threat for the future of your organization and yourself. You might intend to review on for a checklist of factors why employing a monetary advisor is helpful to you and your organization. Running a service contains difficulties.

Cash mismanagement, cash flow troubles, delinquent settlements, tax concerns and other monetary problems can be important sufficient to close an organization down. There are many methods that a qualified financial advisor can be your partner in aiding your organization thrive.

They can collaborate with you in reviewing your economic situation on a regular basis to avoid serious blunders and to promptly fix any type of bad cash decisions. A lot of little company owners put on many hats. It's understandable that you wish to save money by doing some work on your own, but handling funds takes expertise and training.

Some Known Facts About Guided Wealth Management.

Preparation A organization plan is important to the success of your business. You require it to understand where you're going, just how you're obtaining there, and what to do if there are bumps in the road. An excellent financial consultant can assemble a detailed strategy to assist you run your service a lot more successfully and plan for anomalies that arise.

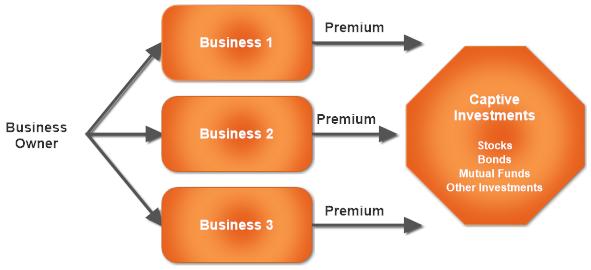

Wise financial investments are essential to accomplishing these objectives. Many organization proprietors either do not have the proficiency or the moment (or both) to evaluate and assess financial investment opportunities. A reliable and knowledgeable economic advisor can lead you on the investments that are right for your organization. Money Cost savings Although you'll be paying an economic consultant, the lasting savings will justify the expense.

Minimized Anxiety As a company proprietor, you have great deals of points to stress around. An excellent economic expert can bring you tranquility of mind understanding that your financial resources are getting the focus they require and your money is being spent wisely.

Guided Wealth Management for Dummies

Security and Development A professional economic expert can offer you clearness and assist you focus on taking your company in the appropriate direction. They have the tools and sources to use methods that will ensure your service grows and flourishes. They can aid you examine your goals and determine the most effective course to reach them.

8 Simple Techniques For Guided Wealth Management

At Nolan Accountancy Center, we give experience in all aspects of monetary preparation for small companies. As a tiny company ourselves, we understand the challenges you face on a daily basis. Provide us a call today to review exactly how we can assist your company flourish and do well.

Independent possession of the technique Independent control of the AFSL; and Independent commission, from the customer only, through hop over to these guys a fixed dollar fee. (http://prsync.com/guided-wealth-management/)

There are many advantages of a monetary planner, no matter of your situation. But regardless of this it's not unusual for people to second assumption their viability as a result of their setting or existing financial investments. The aim of this blog site is to verify why everyone can gain from a financial strategy. Some common problems you may have felt on your own consist of: Whilst it is simple to see why individuals may believe this method, it is certainly wrong to deem them deal with.

Report this page